time:2024-01-05 source:高工锂电网

The electrification of the global automotive industry is currently being deeply promoted, and under the wave of the new energy revolution, the new energy vehicle industry has become a key direction of development for various countries. Based on the tracking research of the new energy vehicle industry in the past year, the Institute of Advanced Industries (GGII) has put forward ten major predictions for the new energy vehicle market in 2024:

1. The global penetration rate of new energy vehicles is expected to approach 20%

In 2023, global sales of new energy vehicles will exceed 15 million units; It is expected that by 2024, global sales of new energy vehicles are expected to exceed 18 million units, and the penetration rate of global car electrification will be close to 20%.

Data source: China Association of Automobile Manufacturers, GGII Prediction

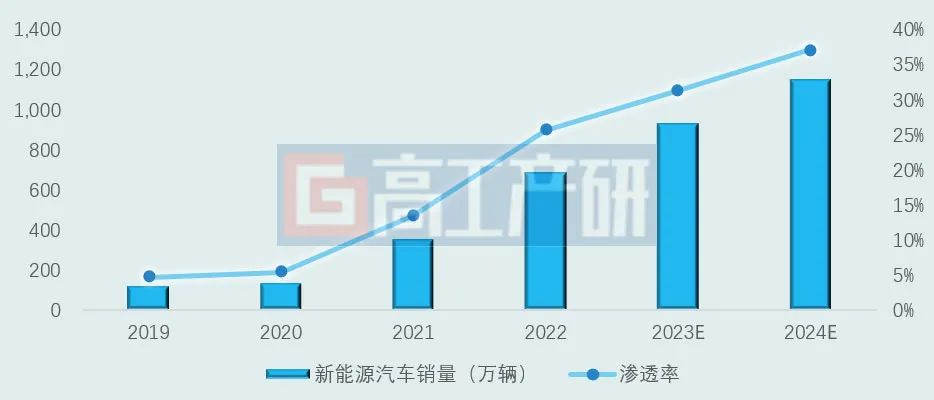

2. The total sales of new energy vehicles in China will reach 11.5 million units

In 2023, the sales of new energy vehicles in China are expected to reach 9.3 million units, with an electrification penetration rate of 31.2%; In 2024, despite the continuous decrease in the cost of core components such as power batteries and the launch of more and more diverse vehicle models, the sales of new energy vehicles in China will continue to grow. It is expected that the sales of new energy vehicles in China will reach 11.5 million units (including exports) by 2024, and the penetration rate of electrification is expected to exceed 37%. Among them, the sales of new energy passenger vehicles are 11 million units, and the penetration rate of electrification is expected to exceed 40%.

Domestic sales and forecast of new energy vehicles from 2019 to 2024

Data source: China Association of Automobile Manufacturers, GGII Prediction

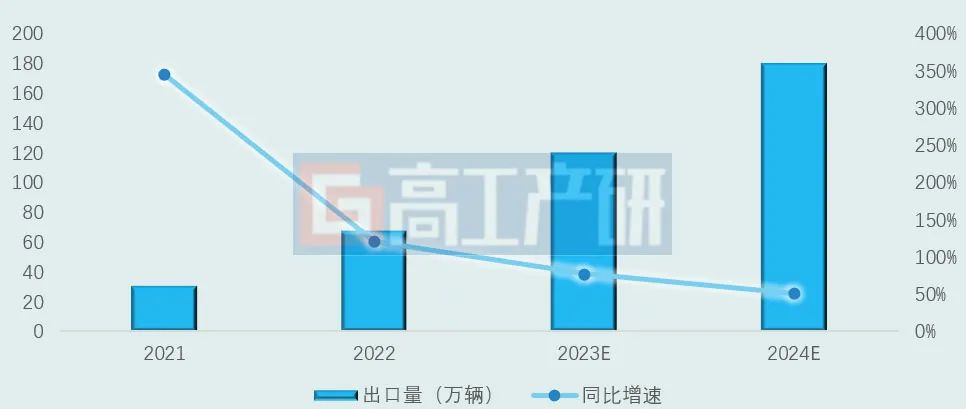

3. China's new energy vehicle exports are expected to exceed 1.8 million vehicles

In 2021, China's export of new energy vehicles reached 310000 units, a year-on-year increase of three times, making it the world's largest exporter of new energy vehicles; In 2022, the export volume exceeded 670000 vehicles, doubling the growth rate; Since 2023, China's new energy vehicles have continued to grow. From January to November 2023, China's new energy vehicle exports reached 1.091 million units, a year-on-year increase of 83.5%. The annual export volume is expected to reach 1.2 million units.

In 2024, despite facing a series of unfavorable external environments, such as the EU's possible anti subsidy investigation into China's new energy vehicles and the release of the US FEOC regulations, it will not reverse the sustained growth trend of China's new energy vehicle exports. It is expected that the export volume of new energy vehicles in China will reach 1.8 million in 2024, with a year-on-year growth of over 50%.

China's New Energy Vehicle Export Volume from 2021 to 2024

Data source: China Association of Automobile Manufacturers, GGII Prediction

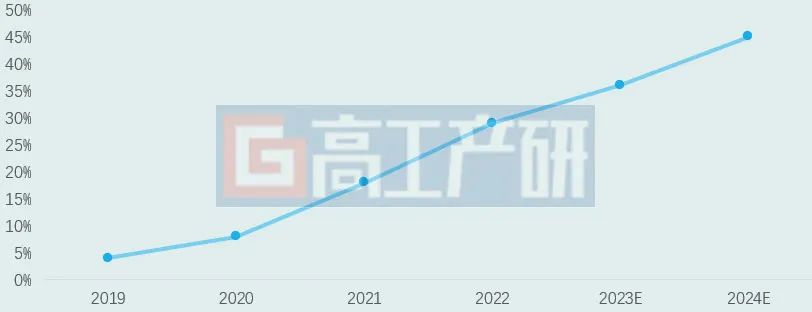

4. Accelerated penetration of automotive intelligence, large-scale implementation of urban NOA

With the gradual improvement of autonomous driving technology in algorithms and functions by car companies, coupled with the cost reduction of intelligent driving, the price of models equipped with intelligent driving functions has dropped, promoting the acceleration of intelligent driving penetration rate. GGII predicts that the passenger car L2 (including L2+) occupancy rate in the Chinese market will exceed 45% by 2024.

Passenger car L2 (including L2+) occupancy rate and forecast in the Chinese market from 2019 to 2024

Data source: Compulsory Traffic Insurance caliber, GGII forecast

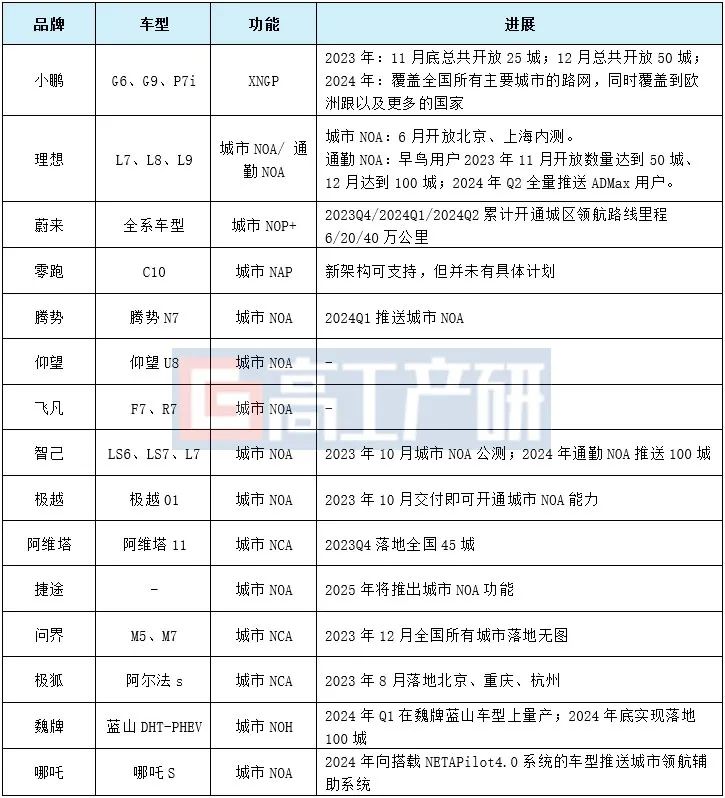

With the support of the AI big model, as BEV+Transformer gradually becomes the mainstream paradigm, domestic high-speed NOA is maturing. Both traditional car companies and new force enterprises are actively laying out their efforts, and it is expected that urban NOA will be implemented on a large scale in 2024.

List of NOA Implementation in Cities of Domestic Automobile Enterprises

Data source: Public information, GGII forecast

5. Product price war intensifies, and the era of "oil and electricity at the same price" is fully approaching

In 2023, the electrification rate of China's automotive industry officially entered the era of over 30%. With the slowdown of the incremental market growth rate of the automotive industry's electrification, competition in the existing market will begin to intensify. In December, a new round of price war in the new energy vehicle industry has begun. Ideal, NIO, Nezha, and Jike have offered discounts ranging from 10000 to 50000 yuan to some models, while BYD has reduced prices across the entire range, with discounts ranging from a few thousand yuan to tens of thousands of yuan.

Although price war has become one of the main themes of the new energy vehicle industry in 2023, with intensified market competition, price war will still be the main tone of industry competition in 2024. At the same time, with the continuous decline in prices at various links of the industrial chain and the continuous increase in industry scale, the era of "oil and electricity at the same price" is expected to fully come in 2024.

6. The high-end development of passenger cars continues, with B-class and above models expected to account for 50%

In recent years, there has been a clear trend towards high-end development of new energy passenger vehicles in China. From January to October 2023, the proportion of B-class and above new energy passenger vehicle models reached 46.4%, while in 2022 it was 35.2%. With the decrease in battery prices and the synchronous decline in prices of B-class and above vehicle models, coupled with the launch of more competitive B-class and above vehicle products, it is expected that the sales proportion of B-class and above vehicle models in China is expected to reach 50% by 2024.

Sales proportion of each model level from 2018 to 2023

Data source: China Association of Automobile Manufacturers, GGII Prediction

7. The annual sales of new energy logistics vehicles are expected to exceed 400000 in 2024

From January to October 2023, the cumulative sales of new energy commercial vehicles reached 254000 units, with a penetration rate of 9.8%. The penetration rate of electrification for logistics vehicles, heavy-duty trucks, and other vehicles is lower than the overall penetration rate of commercial vehicles. According to the GGII compulsory traffic insurance standard data, the cumulative sales of new energy logistics vehicles in China in the first 10 months of 2023 were 199000 units, and the annual sales are expected to reach 280000 units, a year-on-year increase of 23%. Against the backdrop of cost reduction and carbon reduction in the logistics industry, accelerating the replacement of oil and electricity for logistics vehicles has become a trend. Coupled with the decrease in battery prices, the electrification of logistics vehicles is expected to accelerate. It is expected that the sales of new energy logistics vehicles in China will exceed 400000 in 2024.

Sales volume and forecast of new energy logistics vehicles from 2021 to 2024

Data source: Compulsory Traffic Insurance, GGII Forecast

8. The proportion of PHEV/extended range vehicles is expected to increase to 35% in 2024

According to data from the China Association of Automobile Manufacturers, from January to October 2023, the proportion of PHEV/extended range sales has increased to 32.4%, an increase of nearly 10 percentage points from the previous year. BYD and Ideal rely on their strong product capabilities to lead the rapid growth of the PHEV and REEV markets, especially in the extended range market. Ideal ONE, Lantu FREE, AITO WENJIE M5, WENJIE M7 and other markets have seen considerable sales, leading more car companies such as Changan, Nezha, Celes, Geely, Xiaomi, etc. to start laying out extended range models. It is expected that by 2024, driven by the extended range market, the proportion of PHEV/extended range passenger vehicle sales in new energy passenger vehicles is expected to increase to 35%.

Sales and forecast of PHEV/extended range passenger vehicles in China from 2021 to 2024

Data source: China Association of Automobile Manufacturers, GGII Prediction

9. Further acceleration of "reverse joint ventures" in the new energy vehicle market in 2024

Since 2023, major overseas OEMs such as Volkswagen's strategic investment in Xiaopeng, Audi's cooperation with SAIC Zhiji, and Stellantis's investment in Zero Run have collaborated with domestic new forces, hoping to help transform their own electrification business through leading domestic electrification platforms. After several years of development, China has successfully achieved reverse exports in the field of technology in the new energy vehicle industry. It is expected that the "reverse joint venture" in China's new energy vehicle market will continue to break through in 2024, and more overseas OEMs will seek high-quality cooperation targets in China to promote the development of their own new energy business.

10. 800V high-voltage fast charging is gradually becoming standard for B-class and above models

At present, 800V high-voltage fast charging basically covers B-class and above vehicle models. In 2022, the market penetration rate of 800V high-voltage fast charging models in B-class and above vehicle models is about 5%. In 2023, multiple car companies will launch 800V high-pressure fast charging models, such as BYD, Ideal, Xiaopeng, NIO, Geely, Zhiji, Avita, GAC, Hechuang, Jixing, BAIC, etc. The annual penetration rate of 800V high-pressure fast charging models in the B-class and above vehicle market is expected to reach 15%.

In 2024, with the construction and improvement of supporting facilities for 800V high-voltage platforms, and the launch of more 800V high-voltage platform models by car companies, it is expected that the penetration rate of 800V high-voltage platform models in the B-level and above market will exceed 30%.

Some released and pending models that support 800V high-voltage fast charging

Data source: Public information, GGII forecast